By Erin Hamalainen, Head of Data Analytics & Insights, The Fred Hollows Foundation

We all know the main aim of fundraising – to bring in income. As charities aim for bigger impact to meet increasing need, fundraisers find themselves with higher income targets year-on-year. While income is an important metric to measure, it’s usually the outcome of a bunch of other stuff you’ve done to get there. It’s important to understand all the factors that feed into this result.

Think of fundraising metrics as pieces of a puzzle. Each metric is a unique puzzle piece. Put them all together, and you get a complete picture of how well your fundraising program is working. Just like a missing puzzle piece leaves a hole in the big picture, ignoring certain metrics leaves gaps in our understanding of how our fundraising programs are going. To solve the puzzle – or in our case, run a successful fundraising program – we need all the pieces. That means looking at lots of different metrics to hit our goals.

This might feel a bit overwhelming for some. You may be unsure where to start – but here’s the good news: The Benchmarking Project makes this easy for you! Whether you’re aiming to stabilise your income or make it grow, the Power BI reports provide key metrics that you can use alongside strategic goals to guide your programs.

Single Giving Acquisition – Sector Trends

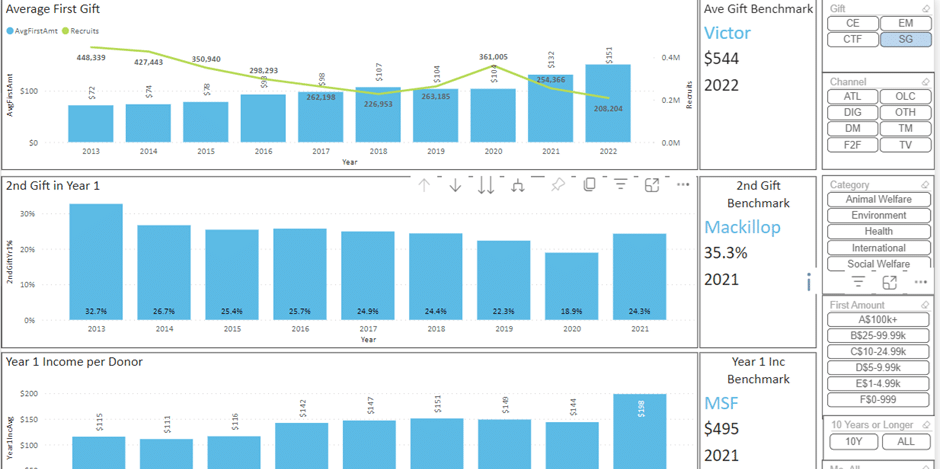

Benchmarking results show us that over the past decade or so, the number of new donors acquired across the sector has declined by ~46%. Why? The traditional channels for reaching people aren’t as effective anymore, and those shiny new digital channels haven’t proven as easy to scale as we hoped. There has also been a shift into more sustainable programs like Regular Giving.

But there’s a twist: although we’ve seen the number of new single giving donors decline, the money we’re getting from each new donor in their first year of giving has increased by 70%, hitting around $198 per recruit.

You’d think that’s all the good news we need, right? Hang on, there’s other factors at play! Increasing expenses and retention trends affect the longer-term views of our programs and can build a case for – or against – investing in certain channels regardless of the cost per acquisition.

Understanding all these pieces of the puzzle can give you some clear data-driven insights to help form strategies to grow your programs. Now let’s look at a charity-specific example to drill down further.

Single Giving Acquisition – How to get the numbers

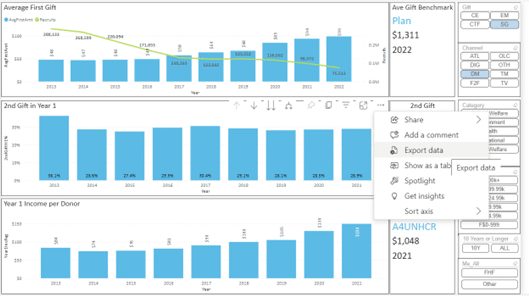

Power Bi gives us some pretty visuals to show growth over time. It allows us to report upwards and across the business. But sometimes you still want to get down and dirty in Excel.

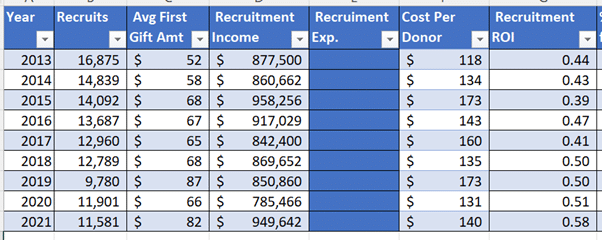

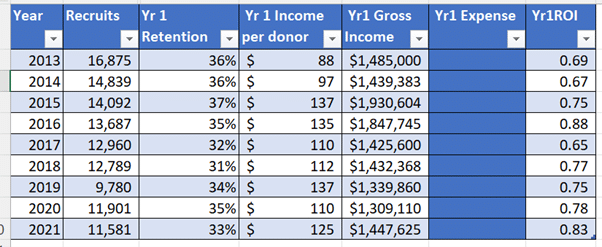

We exported the numbers from the Individual Giving Report for SG Acquisition Trends tab (above) to drill down into Charity X. The metrics we needed were formatted into data tables (below) to give us the metrics we needed. We appended topline expenses for the programs in question, including an assumed $10 per donor retention cost. From there we could calculate Acquisition and Yr1 ROI.

Single Giving Acquisition – What do the numbers tell us?

Recruits: The number of recruits has been on a downward trend for the last 10 years, in line with benchmarking results.

Avg First Gift Amt: The average gift has increased over the years to $30 by ~57% – this is well above the inflation of ~15%. The average gift is typically lower than benchmark.

Recruitment Income: Has held steady over the years – despite declining donors – because of the increase in average gift. However, we are seeing a higher Cost Per donor which is driven by response rate (number of recruits).

Recruitment ROI: Has improved over time, as we are seeing a higher average gift with costs within a 20% range across the years.

We can also look at Year 1 metrics to see the longer-term impact of the drop in donors:

Yr1 Retention: Fluctuates slightly year on year but in general has trended slightly down.

Yr1 Income per donor: Has increased over the years by ~70%.

Yr1 Gross income: Has fluctuated but in general has remained around the same (with a few exceptions).

Yr1 ROI: Has increased over time.

So what?

I always ask this question when looking at data and reports, to try and understand the meaning behind the data.

In a nutshell, Charity X has seen a decline in new donors over time. They are spending around the same amount of money but are receiving more because of the increasing average gift. This is being sustained through to the end of Year 1 as they have good Yr 1 retention and Yr1 income. This is increasing the Yr1 ROI over time.

If we wanted to see improvements in the ROI and/or gross income of this program we could work towards increasing the first average gift (to be in line with benchmark) by testing pack creative, focus on improving Yr1 Retention to lift the Yr1 Income over time and/or find ways to reduce expenses.

Conclusion

Our case study shows how you can use benchmarking data – together with your strategic plans – to hit those fundraising goals that always seem to be getting higher. If you want to dig deeper into your program, here are six easy steps to follow:

- Pick the program you want to focus on and how you’re going to approach it.

- Get all the data that matters – like those benchmark numbers and how much you’re spending on the program.

- Look at how things have been going over time and see how they stack up against the typical benchmarks.

- Now, the big question: “What does all this data really mean?”

- Once you’ve got these cool insights, you can use them to plan for the next year or your next big campaign.

- Just keep at it! Rinse and repeat. You’re on your way!

There you go – a simple way to dive deep into any program you want to tackle using all the metrics Benchmarking has to offer.

If you’d like to get in touch with Erin to discuss further, please connect with her via LinkedIn at: Erin Hamalainen | LinkedIn