The dominance of Face to Face (F2F)

Australian public fundraising with individuals is dominated by regular giving. And any conversation about monthly giving in Australia is going to have to start by talking about F2F. F2F has dominated regular giving for two decades.

Face to face has reached new audiences, built strong brand recognition, and even increased trust and reputation.

Despite decreasing retention, increasing costs and even a devastating pandemic F2F has remained the dominant tactic for bringing new people on board for many charities.

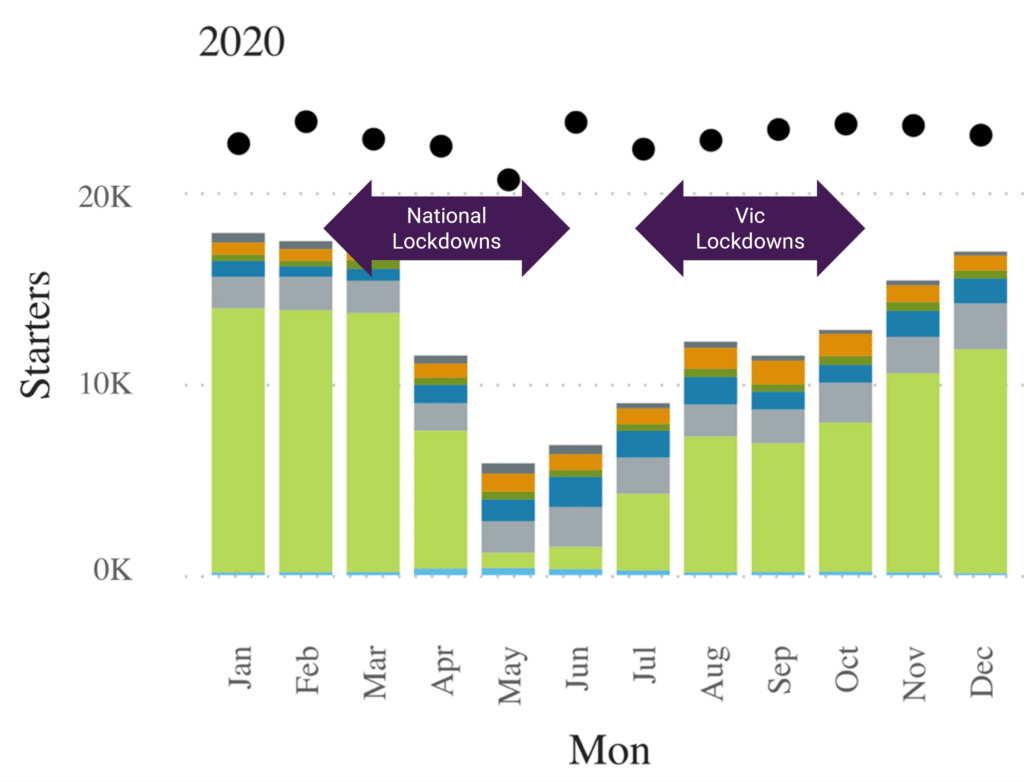

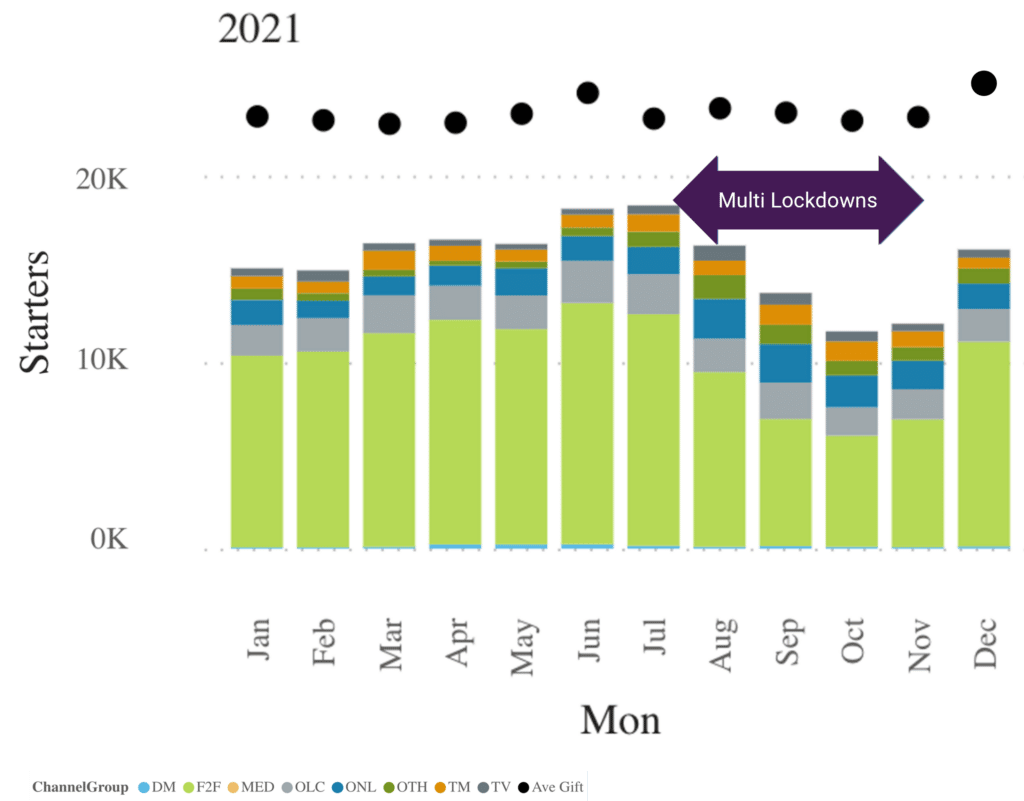

So, what happened to regular giving, especially F2F, during the tough COVID19 lockdowns?

F2F (and other channels!) during the COVID19 lockdown years

I found this data surprising. Empty streets, closed international borders and a general fear and frustration of people living with lockdown. With so much to worry about – did people still have love and compassion that compelled them to donate to charity?

As you can see, F2F was hit hard during lockdowns, but bounced back fast. Agencies struggled to survive, but an unusual comradery between commercial competitors arose – which even included F2F agencies ‘lending’ staff to competing call centres.

Compared to previous years, RG acquisition overall plummeted.

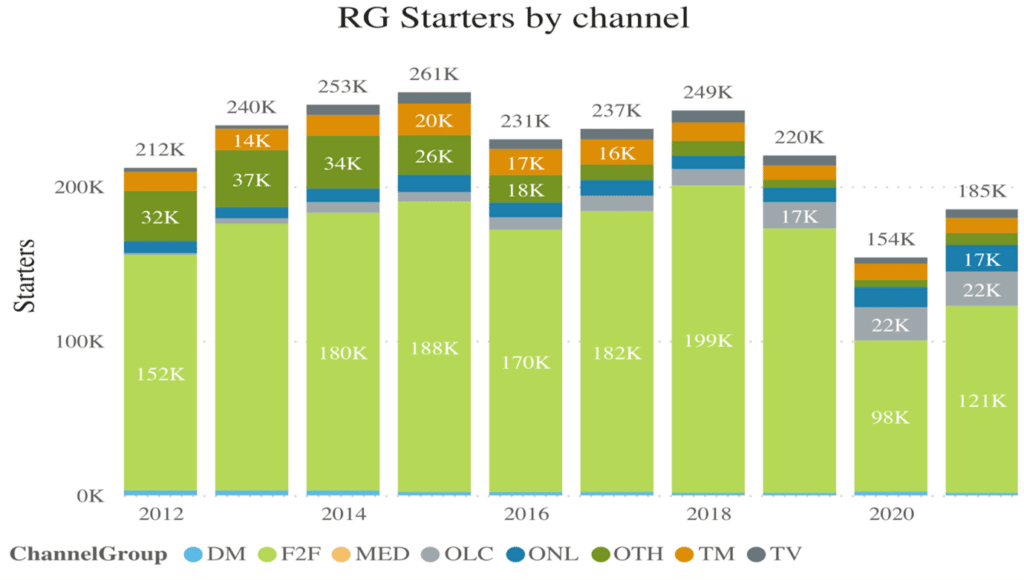

Pre COVID19, F2F was hovering around 177,000 new regular givers per year – a massive 75% of ALL new regular givers game through F2F.

And, despite lockdowns and closed borders, F2F still ‘ruled the roost’ in 2019 and 2020 – accounting for two-thirds of the new RGs in those years.

Many fundraisers tried hard to boost their alternative RG acquisition sources – mostly online and usually involving the phone. However, this switch didn’t come close to making up for the decline in F2F.

In 2019, about 50k lovely new people became regular givers from non-F2F channels. But in 2020, fundraisers new focus beyond F2F reversed the downward trend for alternatives to 56k. And in 2021 it picked up even more to 64k.

Whilst the overall reduction in acquisition spend meant less pressure on cash flow during COVID19 (charities spent about $50m less on getting new donors in 2020) it will have an impact on future net income. To some extent this is mitigated by the fact that during COVID19 worst two years, retention held steady.

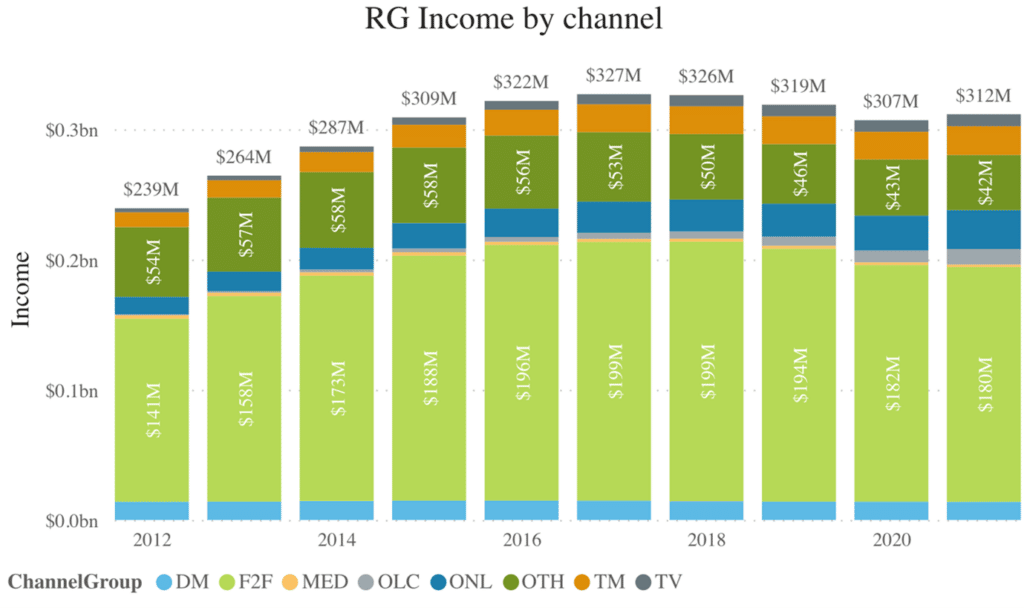

As you can see from the chat above, income had declined a little from the peak of 2017 but only dipped 4% in 2020 (compared to a drop in new recruits of 30%).

Great data, but what does this mean for us?

We know we need to diversify channels, and many are doing that successfully. But we are quite a long way from replacing F2F. As long as you are getting a reasonable return on investment* from F2F it still has to be in your RG acquisition portfolio.

We can’t ‘invent’ many more channels. There are only a couple of handfuls of ways it is possible to communicate with broader audiences after all. So we need push and try creative and technical innovations to reduce cost per acquisition, increase volume and increase retention.

The Royal Flying Doctors Queensland holds the record for best F2F retention. According to Paul Tavatgis (one of the founders of The Benchmarking Project) it is “…because they (well Erin) have absolute best practice for managing quality in F2F and they have a proposition that is almost impossible to beat.”

The bottom line: retention starts with the acquisition of new donors. It’s the quality of the training and support of the frontline F2F fundraisers that makes a huge difference.

F2F is seen as a ‘fire and forget’ process but actually, charity fundraisers need to be hot on the tails of their supplier, checking quality, mystery shopping and being on top of the numbers every week.

We will keep you up to date with more information from The Benchmarking Project. Let us know if there is anything specific you’d like to hear about.

Examples we will feature in presentations and/or other articles include:

- Moving from monthly to 4 week donations (idea is 4 more weeks of donations and it ties in with many pay cycles).

- Instant debit at point of acquisition

- Remuneration structures that keep suppliers in business, but get the ‘right’ donors

- Auto-upgrade, where donations from retained donors are increased automatically.

-

Knowing what your F2F and TM fundraisers are saying, and managing agency partnerships to maximise quality and retention.

Conclusion

Despite the pandemic, fundraising has held up as a good investment for charities in Australia.

Credit is due to the hard work of fundraisers in years past but really, this is all about the generosity and love from the hundreds of thousands of people who kept giving through tough and uncertain times.

—

*All of the above charts are about volumes of donors, channels, and income. The full benchmarking dataset includes costs too, allowing us to look at net income and return on investments – there’ll be some more information about this shared too.

Sean Triner, Founder and Fundraisingologist at Moceanic, a Collaborator of The Benchmarking Project. seant@moceanic.com.