By Kate Burtt, Retention Executive – Individual Giving, Starlight Children’s Foundation

When starting out, or working to improve, a regular giving program, it’s easy to focus on ‘big ticket’ items – channel, pitch, product, acquisition targets, choice of supplier etc. We often miss important opportunities for improvement by not paying close enough attention to the details.

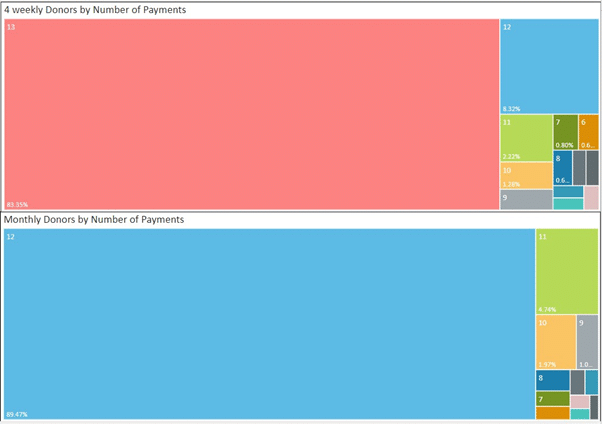

Declines management is an excellent example. Benchmarking shows that if we breakdown the number of RG payments received in 2022, 89.5% of monthly donors made 12 payments, and 83.35% of 4 weekly made 13. While declines may seem ‘incidental’, failure to effectively manage this area of your program can significantly impact your organisation’s annual regular giving income.

A robust declines management program is critical to optimising your regular giving income and managing the payments of your active donor base. It will also reduce the number of donors who attrite due to failed payments. Here are six top tips for managing declines in your Regular Giving program:

Tip 1: Know your payment providers.

Tip 2: Get a list of payment decline reasons from your provider(s).

Tip 3: Ensure these reasons are coded into your database.

Tip 4: Create a business rule for the number of reattempts you will try in a monthly payment cycle for your soft declined credit card donations.

Tip 5: Create a business rule for how many consecutive failures you will allow a donor to have before cancelling their gift.

Tip 6: Consider your communications to declined donors.

If you would like to further discuss declines management, please don’t hesitate to reach out to Kate via LinkedIn: https://au.linkedin.com/in/kateburtt